| | | | |

| | | |

2021

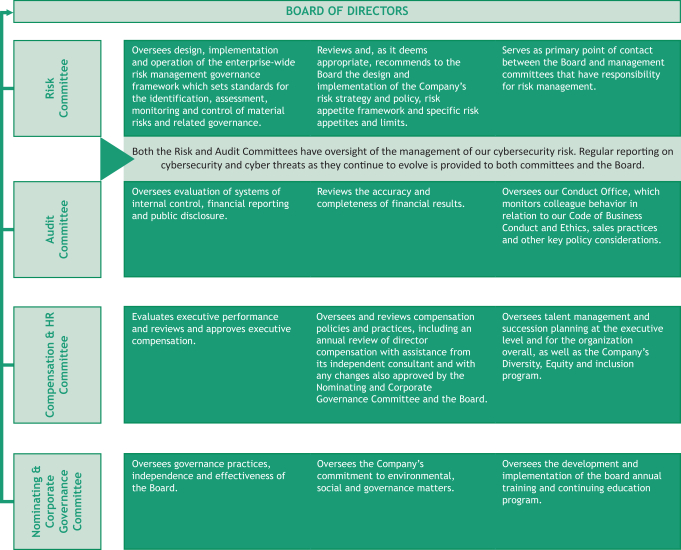

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | | | | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - CORPORATE RESPONSIBILITYRISK COMMITTEE

|

| Oversees our commitment to ESG matters including implementation of our ESG strategy, completion of materiality assessments, and the evolution of our ESG practices. | | | | Oversees risks associated with ESG-related matters through its oversight of the operation of the Enterprise Risk Management Governance framework under which all risks are managed. |

| | | | |

| | | |

COMPENSATION & HR COMMITTEE | | | |

AUDIT COMMITTEE | SUPPORTING SOCIAL EQUITY IN OUR COMMUNITIES

Oversees compensation programs and policies, talent management and succession, and our diversity, equity and inclusion program. The Compensation and HR Committee also evaluates executive performance and approves executive compensation. | | | | Oversees the integrity of our financial reporting and the independence and performance of our independent auditors, the internal control environment applicable to material ESG disclosures, and the Conduct Office, which has responsibility for identification and oversight of risks associated with our culture and conduct. |

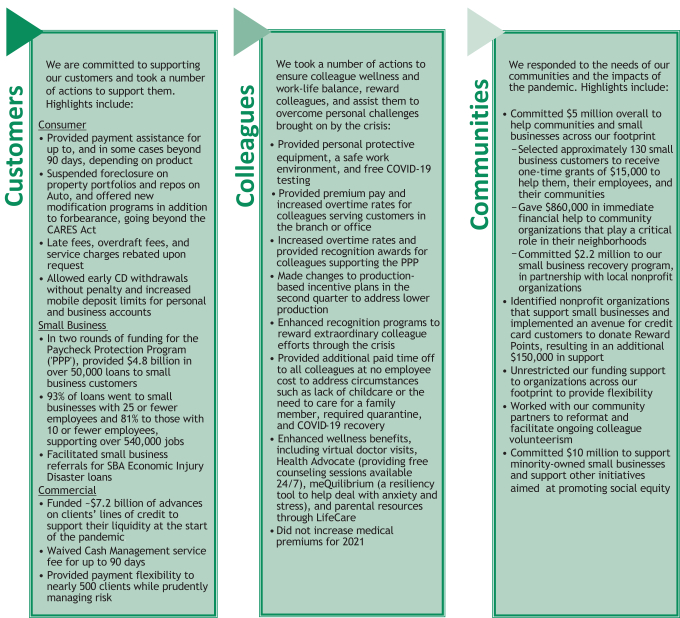

Management of ESG Greater awarenessBoard oversight is supported by a management structure which facilitates the provision of strategic direction and concern over racial equityguidance, coordinates the execution of ESG initiatives, and social justice, driven in part by the disparate impactsensures appropriate management of the pandemic, have comeESG risk. This structure includes management oversight forums with executive engagement and accountability. In addition to the forefrontmanagement structure, ESG-related working groups drive implementation of 2020. Our commitment to help drive social equityESG initiatives and economic opportunity extends internally as well as tovarious risk forums ensure ESG risks are integrated into our communities and in 2020 we announced a $10 million investment to help drive social equity and economic advancement in underserved communities across our footprint, which includes grants and charitable support for immediate and longer-term initiatives aimed at supporting minority-owned small businesses, increasing awareness of racial disparities and supporting underserved communities through technology, education and digital literacy initiatives. Our commitment also includes more than $500 million in incremental financing and capital for small businesses, housing and other developments in predominately minority communities.Enterprise Risk Management Governance framework.

| | HUMAN CAPITAL

RELATED MANAGEMENT STRUCTURES | Executive Committee The Executive Committee, chaired by our Chairman and Chief Executive Officer, advises on ESG-related commitments with business impacts as well as select ESG disclosures. ESG Executive Steering Council The ESG Executive Steering Council co-chaired by our Chief Financial Officer, and our Chief Experience Officer and Head of ESG, provides oversight and strategic guidance on our ESG strategy, helps integrate our efforts across our lines of business, and monitors progress. Reputation Risk Forum The Reputation Risk Forum reviews business exposure and the external landscape on sensitive ESG topics, including climate-related sectors. The reputational risk associated with certain sectors is considered in making recommendations for future exposure. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 34 | | 2023 PROXY STATEMENT |

Citizens’ colleagues

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE MATTERS In support of our continued ESG efforts, we created a number of senior leadership roles over the last two years. In 2021, we created a new Head of Sustainability position to develop a strategic approach to the Company’s environmental and social initiatives, with a focus on climate. In 2022, our Chief Experience Officer was also appointed Head of ESG, with the goal of accelerating and aligning our ESG efforts. In this role, the Head of ESG, supported by the Head of Sustainability, is responsible for a centralized ESG function focused on enhancing mechanisms to measure progress on ESG priority topics and supporting our businesses as they develop and execute ESG products and strategies. In addition, in 2022, we appointed a Head of Climate Risk Management to further governance of the risks associated with climate change and the regulations and disclosures related to those risks. LEADING WITH ROBUST CORPORATE GOVERNANCE Strong corporate governance is foundational to how we do business and one of the four pillars of our ESG strategy. It requires going beyond compliance to create an ethical culture which promotes the long-term interests of customers, employees, stockholders, and other stakeholders at all levels of the organization. Having the right governance structures and systems in place is essential in ensuring we make sound business decisions. Our corporate governance framework is grounded in our Board, and encompasses policies and procedures, together with structures and systems, which are designed to ensure a consistent approach to our governance throughout the Company, facilitate effective execution of the Board’s oversight function and promote confidence in how we manage our business. Our key corporate governance practices are described in more detail throughout this Proxy Statement. DRIVING POSITIVE CLIMATE IMPACT We are committed to reducing our operational impact on the environment, understanding and managing the risks and opportunities for our business presented by climate change and resulting regulatory and market changes, and helping our customers plan for and manage climate change impact. As we seek to understand the potential risks of climate change to our business, we are working to identify, address and disclose related risks in our value chain, including potential extreme weather impacts of climate change, and the risks associated with regulatory or market changes that emerge as part of the transition to a lower-carbon economy. In addition to added resources focused on climate, we have assembled working groups in our Commercial and Risk divisions to drive this work and are using the recommendations from the TCFD to guide our efforts. In connection with our own operational sustainability efforts and to better meet internationally recognized goals to foster climate resilience and limit global temperature increase, we set targets to reduce our Scope 1 and 2 Greenhouse Gas (“GHG”) emissions 30 percent by 2025 and 50 percent by 2035, based on our 2016 baseline. These reductions align with recommendations of the Paris Agreement, which aims to limit average global temperature increase to well-below 2° Celsius compared to pre-industrial levels. Our 2021 emissions brought us in line with our 2025 targets and we seek to sustain these reductions over time as the impacts of the COVID-19 pandemic recede. In accordance with our environmental policy, we measure and track our environmental performance utilizing a data gathering program which includes energy, water, paper, waste, recycling, GHG emissions, and business travel. We report our performance each year through the CDP Climate Change Questionnaire Response, which most recently received a score of “B”, and can be viewed on our website. In addition, in 2022, we entered into a virtual power purchase agreement with Ørsted that supports the construction of a wind generation facility. We expect our share of the project to generate power equivalent to what we will use by 2024. The electricity will be delivered to the local grid, while Citizens utilizes the associated renewable energy credits to match 100 percent of its power consumption. | | | | | | CITIZENS FINANCIAL GROUP, INC. | | 35 | | 2023 PROXY STATEMENT |

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE MATTERS We are actively focused on identifying and supporting new emerging growth sectors and companies whose products and services will be critical to a sustainable, lower-carbon economy. We believe this focus on sustainable growth enables us to better serve clients, and at the heartsame time deliver attractive returns for our stockholders, and address one of society’s greatest challenges. We have an important role in accelerating a more sustainable future and are committed to supporting our Credoclients’ transitions. We are helping our clients navigate the challenges and opportunities related to climate change in our ultimaterole as a trusted advisor and by providing products and services that help them achieve their goals. In 2021, we launched Green Deposits, a program that allows corporate clients to direct their cash reserves toward companies and projects that are expected to create positive environmental impact. Citizens developed its Green Deposits Framework to identify eligible activities within the bank’s portfolio and ensure alignment with best practices and standards. The framework was created in line with eligibility criteria developed with the support of Sustainalytics, a Morningstar company, and leading provider of ESG research and data. In 2022, we launched a new Carbon Offset Deposit Account, which provides clients with a way to acquire high quality carbon offsets using credit earned on their deposits. Acquired offsets enable clients to integrate sustainability into their own strategies and products. To meet the unique needs of the renewable energy industry, we provide equity investments to support a greener and more independent energy future through Citizens Asset Finance. We have participated in the funding of nine U.S. wind farm projects since mid-2015, with our investments totaling approximately $375 million at the end of 2022. BUILDING THE WORFORCE OF THE FUTURE We believe that our long-term success depends on our ability to attract, develop, and retain a high-performing workforce. Our goal is to create an environment where colleagues feel valuedcan thrive personally and would likeprofessionally and can maximize their potential. Our Board of Directors and the Compensation and HR Committee are responsible for overseeing our human capital management strategy, with senior management providing regular updates to build their careers, thereby contributingfacilitate that oversight. Leadership, Talent Development, and Talent Acquisition and Mobility Our leaders are the catalysts to achieve the creationculture we want to foster. During 2022, we conducted a detailed assessment of long-term stockholder value. Citizens’ journey over the past few years has been onecurrent state of accelerated progressour culture and change, in step with rapidly evolving market and talent expectations. We have been on the pathleadership to digitization, transforming howinform future areas of focus. As we work, and establishing a different mix of necessary capabilitiescontinue to prepare colleagues for the future, while at the same time facilitating continued evolutionwe are building capabilities by upskilling and reskilling colleagues to support new ways of our culture. Health, Safety,working. We offer technical and Wellness

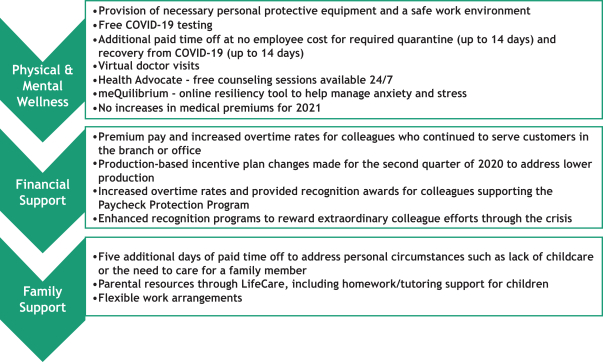

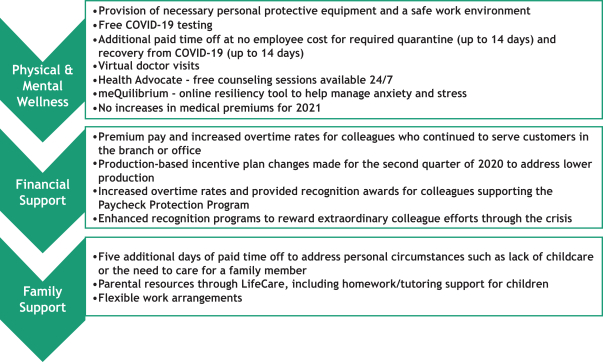

Colleague wellness has always been central to our consciousness and strategy and it was a priority when we were designing our Johnston, RI campus, which opened in 2018 and includes onsite fitness and wellness centers,skills-based programs as well as walking pathsresources aligned with our leadership competencies. To deepen critical skills, we have expanded our learning academies focusing on Innovation, Agile, Next Gen Tech, Banking and various sportsCredit, and recreation facilities.Data & Analytics. Through our development programs, we aim to equip colleagues with the skills necessary to excel in their current roles and to build competencies that will enable them to be highly valuable contributors in the future. Our commitmentculture is one of continuous learning, which we believe is crucial for colleagues to colleagues’ wellness – including physical, financial,thrive as part of our organization and mental wellness –to feel a sense of accomplishment and purpose.

Citizens has continued to beexpand recruiting efforts across the different levels of the organization, with the goal of building a central focus during the COVID-19 crisis. In additionstrong pipeline of future leaders. This includes strengthening opportunities for internal mobility within Citizens through rotational programs and our academies, as well as external partnerships to ensuring thatsupport our colleagues had the necessary toolsability to hire critical talent in areas such as technology, digital, cyber, marketing and resources to continue to serve our customers safely, we shifted approximately 10,000data. Employee Engagement As part of our colleaguesongoing efforts to develop a work-from-home environmenthigh performing workforce and implemented several programsmake Citizens a great place to support their wellnesswork and their abilitybuild a career, we have used McKinsey & Company’s Organizational Health Index (“OHI”) since our 2014 initial public offering to maintain work-life balance, including the below.understand colleagues’ viewpoints about Citizens on a range of topics. OHI results are used to refine our focus, address gaps, and strengthen efforts to improve our organizational effectiveness and

Physical & mental wellness financial support Family support provision of necessary personal protective equipment and a safe work environment free covid-19 testing additional paid time off at no employee cost for required quarantine (up to 14 days) and recovery from covid-19 (up to 14 days) Virtual doctor visits Health Adocate - free counseling sessions available 24/7 meQuilibrium - online resiliency tool to help manage anxiety and stress No increases in medical premiums for 2021 Premium pay and increased overtime rates for colleagues who continued to serve customers in the branch or office Production-based incentive plan changes made for the second quarter to address lower production Increased overtime rates and provided recognition awards for colleagues supporting the Paycheck Protection Program Enhanced recognition programs to reward extraordinary colleague efforts through the crisis Five additional days of paid time off to address personal circumstances such as lack of childcare or the need to care for a family member Parental resources through LifeCare, including homework/ tutoring support for children Flexible work arrangements

| | | | | | | 2021

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - CORPORATE RESPONSIBILITY | | | 36 | | 2023 PROXY STATEMENT |

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE MATTERS In addition,

colleague experience. Since our comprehensive total rewards package includes competitive pay opportunitiesinaugural survey, our overall OHI score has increased nearly 20 points to 77 (in 2022) and benefits designed to support colleague wellness from various perspectives. This offering is regularly evaluated to ensure it continues to meetnow within the needsfirst quartile of McKinsey’s global benchmarks. The results of our OHI survey have been instrumental in helping management prioritize areas of change that are most important to colleagues. ThroughIn 2023, we are transitioning to a new listening platform, which will include a colleague survey tool aimed at providing additional insights as we continue to evolve our comprehensive myWELLNESS hub, we provide resources to help our colleagues getstrategy and stay healthy and also provide incentives for completing wellness activities. Talent Management and Succession Planning

The Board reviews the Company’s talent management and succession plans regularly. Talent management and succession plans for the CEO, including evaluations of successors and related development plans, are provided to the Compensation and HR Committee and to the Board at least annually. A similarly detailed review of talent management and succession plans for the CEO’s management team also occurs annually by the Compensation and HR Committee. The Board’s and Committee’s focus on this topic also extends below the senior executive level. To that end, the Compensation and HR Committee reviews talent management and succession plans for our primary businesses and functions on a regular basis. In addition to focusing on potential successors and team strength, these deep dives also focus on the identification of emerging talent deeper in the organization. Board members also serve as formal mentors to certain members of our executive team, and meet in small group sessions with high-potential leaders across the Company throughout the year.culture.

Diversity, Equity, and Inclusion (“DE&I”) Citizens is committed to building deep partnerships among our customers, colleagues, and communities and fosteringfosters a culture where all stakeholders feel respected, valued, and heardheard. Our DE&I strategy is focused on creating an environment of inclusion and havebelonging, building a sense of belonging. A core tenetmore diverse workforce, and evaluating the effectiveness of our business strategy is growth and innovation and a hallmark of that strategy is to focus on the diversity of our colleagues, customers, and communities and the inclusivity of our culture. To that end, we have been on a multi-year journey to enhance awareness and improve capabilities and opportunities within the bank and in our communities, which has accelerated since we became an independent public company in 2015. Our Compensation and HR Committee directly oversees our diversity, equity and inclusion (“DE&I”) program.initiatives. As part of that journey we have conducted a third-party audit to de-bias our people practices, have put into place several recruiting and development initiatives, and provide unconscious bias training. Information regarding colleague demographics can be found on our website. We acknowledge that there is an opportunity to further increase the representation of women and people of color at all levels of our organization, in particular in senior roles. To enable further progress, we have implemented partnerships with community organizations to help identify qualified diverse candidates and have expanded our diverse hire commitment, through which we interview a slate of at least 50% diverse candidates for senior openings. In addition, our development

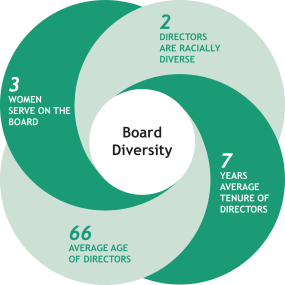

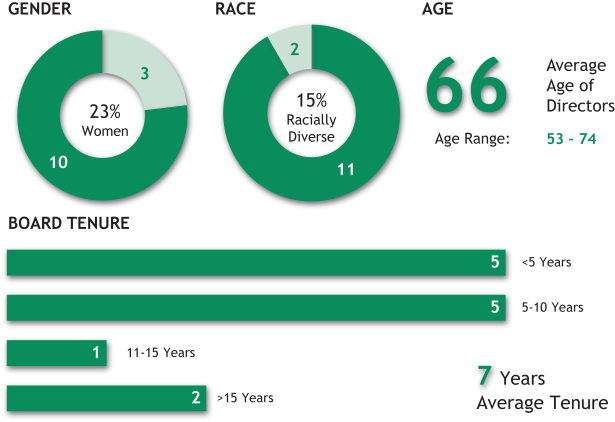

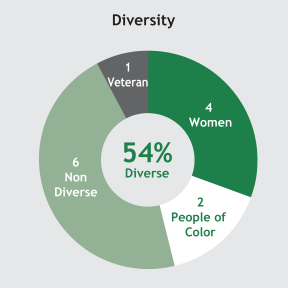

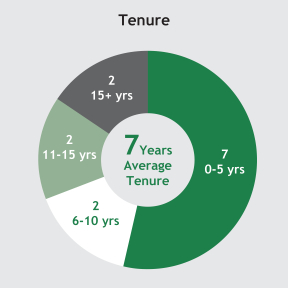

| | | | | Citizens is committed to increasing the representation of women and people of color, particularly in leadership roles. To that end, we have continued to develop strong partnerships with business and community organizations to help identify qualified diverse candidates for roles within every segment of our organization. In addition, through our diverse hiring commitment we aim to have at least 50 percent of candidates interviewed for mid-to-senior openings be women or people of color. Internal diversity scorecards are used to measure our progress across multiple DE&I metrics. As of December 31, 2022, approximately 58 percent of our colleagues were women and approximately 32 percent were people of color. Approximately 31 percent of the members of our Board of Directors are women and approximately 15 percent are people of color. More detail regarding our workforce demographics can be found on our website and in our Corporate Responsibility Report. | | | |

Citizens named as a standout in the Bloomberg Gender-Equality Index 2022 |

Development programs are designed to build a strong pipeline of diverse emerging talent internally. A key catalystDevelopment efforts have been effective in increasing the number of women and people of color considered “ready now” succession candidates. We partner with external organizations to offer additional resources for change within our organization is our six business resource groups (“BRGs”), each of which is sponsored by senior leadersreskilling and which include the following:upskilling diverse colleagues. Citizens WIN (Women); Citizens Elev8 (Rising Professionals); Prism (Multi-Cultural); Citizens Pride (LGBTQ); Citizens Veterans; and Citizens Awake (Disability Awareness). 17% of our population was a member of at least one BRG as of 2020 year-end. BRG members serve as cultural ambassadors within the business to help formulate and influence our DE&I strategy and to identify and solve related issues. Our commitment to diversity, equity and inclusion also extends to our communities. Additional information regarding related initiatives can be found above in “—Supporting Social Equityoffers education programs focused on embedding inclusive behaviors in our Communities.” | | | | |

Recognized in Top 50 of DiversityInc’s Noteworthy Companies for Diversity | | | | Citizens uses various resources to understand what drives a sense of inclusion and a sense of belonging and to identify what actions will be effective in attracting and retaining diverse colleagues. Analytics are used to help prioritize initiatives, including answers to OHI survey items, which we segment by various colleague populations to provide additional insights. Citizens currently has seven business resource groups (“BRGs”), which are an extension of the business and are integral to identifying and formulating solutions to DE&I issues that are most important to customers, colleagues, and the community. Citizens BRGs include Citizens WIN (Women’s Impact Network), Citizens Elev8 (Rising Professionals), Prism (Multicultural), Citizens Pride (LGBTQ+), Citizens Veterans, and Citizens Awake (Disability Awareness). In 2023, we launched an additional BRG, Caring for Citizens (Caregivers). Each BRG is sponsored by a member of the executive team and, as of December 31, 2022, approximately 3,200 colleagues belonged to at least one BRG. |

2021

| | | | | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - CORPORATE RESPONSIBILITY | | | 37 | | 2023 PROXY STATEMENT |

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE MATTERS Commitment

Health, Well-Being, and Workplace Flexibility Citizens prioritizes the health and well-being of our colleagues and their loved ones. Our benefits programs are designed to Pay Equitysupport colleagues’ physical, mental, and financial well-being and we have added several additional resources in recent years, including additional mental and emotional health resources and emergency back-up child and adult care. We also recently enhanced our Parental Leave Policy to provide six weeks of paid time off for all permanent colleagues who become parents; birth mothers are eligible for an additional 10 weeks of paid time off, for a total of 16 weeks. We added an ESG fund to our 401(k) plan investment options and there were no increases to colleague premiums, copays or deductibles for medical, dental, and vision coverage for 2023 in recognition of the impact of inflation on colleagues. PartWe have implemented a thoughtful return to office strategy which incorporates flexibility for colleagues. As part of that strategy, non-branch roles have been assigned to various categories including fully remote, hybrid, or fully in the office, based on the responsibilities of each role. This approach has allowed us to balance colleague flexibility with in-person collaboration, which we believe is key to maintaining our Company values and culture.

Fair and Equitable Compensation Our commitment to building and fostering a diverse, inclusive, and high-performing culture includes ensuring our compensation and benefits are fair and competitive for all colleagues. We continuously evaluate our practices and are committed to identifying opportunities to help ensure that all colleagues have equal opportunity to maximize their potential. Compensation decisions are based on a “pay-for-performance” philosophy, with philosophy. This means compensation decisions are based on a blend of individual performance, business unit performance, and Citizens’ overall performance across variousa number of dimensions, including financial, customer, human capital, and risk and control, financial, and people.control. Managers also receive annual training that includes tools and resources to help them make appropriate compensation decisions during our annual review process. The training resources available to managers include programs designed to ensure that decision-making is not influenced by unconscious bias. Rating and compensation recommendations submitted by managers are reviewed to ensure they are fair and equitable. We engage an independent third-party expert firm to regularlyconduct an annual pay equity analysis. This review colleague pay to ensure that equal pay is received for equal work throughoutcovers all of our organization, accounting foroperations and colleagues and considers factors that appropriately explain differences in pay such as performance timeand experience in role,analyzing base salary, cash bonuses, and experience.equity awards of colleagues serving in similar roles. In the case that job-related factors do not explain a disparity, a pay adjustment is made. The results of our most recent analysis indicate that women are paid 99%99 percent of what men are paid in similar roles and there is no pay disparity for people of color.color are paid 100 percent of what non people of color are paid in similar roles. Although these are strong results, we understand that the opportunity gap for women and people of color continues to exist andexist. We remain committed to the programs described abovewe have in “—Diversity, Equity and Inclusion” have been designedplace to help facilitate, among other things, increasing the representation of women and people of color in senior and leadership roles over time. Growth and Development

The world in which our business operates is changing rapidly in nearly every dimension, and the skills required of our colleagues to meet the evolving needs of customers are changing at an accelerated pace. The Company is in the midst of executing on a large-scale transformation agenda and as part of the path to end-to-end digitization and transforming how we work, we are working to ensure colleagues are reframing their mindsets, behaviors, and capabilities for the future. We invest significant resources in colleague development and offer various programs aimed at equipping colleagues with the skills necessary to not only excel in their current roles, but to build competencies that will enable them to be highly valuable contributors now and in the future and ensure they are in step with changes in the market. Our programs build relevant critical skills such as leadership, agile, digital, innovation, data and analytics, and coaching and advising in order to effectively strengthen the necessary workforce capabilities for our organization. To enable development of these skills we have implemented resources, experiences, and technologies to facilitate quick consumption of new bodies of knowledge and skills. One example of this is learning academies which are enabled by our new learning experience platform to offer a collection of specifically curated learning experiences and content for a particular area of expertise, such as engineering. We have also reframed our performance management process in order to further enable colleague success with ongoing check-ins and feedback as another step toward colleagues being able to contribute at their highest potential.

Engagement and Communication

We use McKinsey & Company’s Organizational Health Index (“OHI”) survey to understand colleagues’ viewpoints about the Company on a wide range of factors to inform decisions regarding initiatives that will drive sustained top-tier performance and growth. In 2020, our OHI overall score reached the top quartile, reflecting a 15-point improvement since 2014. Our success depends on employees understanding how their work contributes to the Company’s overall strategy and we use a variety of platforms and forums to facilitate open and direct communication. These include communications from our CEO and management team through live stream forums, Let’s Connect sessions hosted by members of the management team, and engagement through our BRGs.

| | | | | | | 2021

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - CORPORATE RESPONSIBILITY

| | | | | |

| ENVIRONMENTAL SUSTAINABILITY

|

We are mindful of our impact on the environment and natural resources and we measure sustainability with a goal of continual improvement. We are working to reduce our energy consumption and the amount of waste that enters landfill. We report our performance each year through the CDP.

Through Citizens Asset Finance we have provided equity investments in renewable energy. We have participated in the funding of eight U.S.-based wind farm projects since mid-2015, with our investments totaling approximately $403 million as of December 31, 2020.

| STRENGTHENING COMMUNITIES

|

Helping Citizens Through our Citizens Helping Citizens program, we invest our time, talent, and resources and energy to supportbolster capabilities in the communities wherein which we liveserve. Workforce development and work. Acrossfinancial empowerment are two key areas of focus for our communities, we establish partnerships, volunteer our time and expertisephilanthropic giving and support initiativesour broader initiative to strengthen resources.build the workforce of the future. Our colleagues are central to—and take great pride in—our overall philanthropic efforts, volunteering more than 212,000 hours in 2022 with more than 2,500 organizations. We focus on three specific areas thatDuring 2022, we believe fortify the overall well-being of our communities: Fighting Hunger, Financial Empowermentinvested in workforce development, small business and Strengthening Communities. Acrossneighborhood revitalization projects across our footprint through an expanded partnership with Local Initiatives Support Coalition with an emphasis on digital equity & inclusion. We also funded digital inclusion programs, and efforts to help to build upon and expand digital inclusion work at Financial Opportunity Center® partners within Citizens’ priority markets. In order to understand and discuss issues affecting the local workforce, we support food banks, pantries,convened business, academic and meal sitescommunity leaders in panel discussions with our Chairman and investChief Executive Officer, Bruce Van Saun.

Our efforts in partnerships with hunger relief organizations like Feeding America to combat hunger issues throughout our communities. Our Citizens Helping Citizens Manage Money initiative is our financial empowerment program dedicatedduring 2022 supported Junior Achievement programming in twenty-four lower to middle income communities in the United States impacting a total of approximately 3,200 students in | | | | | | CITIZENS FINANCIAL GROUP, INC. | | 38 | | 2023 PROXY STATEMENT |

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE MATTERS 129 classrooms, and investing in more than 100 organizations providing our communities with the resources, tools and toolstraining to help individuals make informed financial decisions. And lastly, weWe also partnered with Education Design Labs to roll out an innovative new learning infrastructure and develop employer-informed micro pathways at community colleges in Boston, Massachusetts and Philadelphia, Pennsylvania and expanded our investment to support programs and organizations that strengthen communities through economic development, job training and small business development.the City University of New York college system. FOSTERING STRONG COMMUNITIES We also work to strengthen ourlocal communities by providing financial resources that enablefoster development. Our Community Development loans and investments allow organizationscapital allows our community partners to advance their plans to expand affordable housing and community services, revitalize communities, and fuel economic development.development and opportunities. We provide support in the form of loans and equity investments. We fund development opportunities sponsored by Community Development Corporations, Community Development Enterprises, Community Development Financial Institutions and other public welfare investments leveraging tax-advantaged tools like Low-Income Housing and New Markets Tax Credits. While the pandemic put some limitationsWe continued to execute on our colleagues’ ability2020 commitment to dofund up to $50 million to Community Development Financial Institutions to provide working capital lines of credit, small business loans, microloans, and reconstruction loans to non-bankable Black- and brown–owned businesses. As of December 31, 2022, we invested $58 million in person volunteerism,21 organizations. We also continued to deliver on our 2020 commitment to invest $300 million in Low-Income Housing Tax Credit developments in predominantly minority census tracts by the end of 2024. The premium we foundpay on these investments is used to help address the digital divide at no cost to residents, by providing features such as technology centers with computer workstations and internet connectivity. As of December 31, 2022, we provided approximately $160 million in funding for Housing Tax Credit developments.

Home ownership is a goal for many individuals and families, and we work with our customers to determine if home ownership is right for them, obtain a loan to fit their budget, and make an informed decision. Our Portfolio Loan Program provides first-time homeowners with lower rates and more flexible underwriting requirements. Low- to moderate-income (“LMI”) individuals, and/or those purchasing a home in LMI neighborhoods can qualify for the program, which allows a low down payment with no mortgage insurance. It can also be combined with approved community seconds, which are grants and subsidies provided by local organizations. In addition to offering innovative waysloan programs, we help address a key element of the home purchase affordability gap by providing closing cost assistance grants to volunteer virtually during 2020.eligible LMI homebuyers or those buying homes in LMI tracts. To support our national partnership with Feeding America,expand borrowing options for LMI homeowners, we engaged colleagueshave created the Citizens GoalBuilder™ Home Equity Line of Credit. With lower credit limits and FICO requirements, GoalBuilder™ provides an affordable borrowing option to a wider range of customers using equity in their homes. For these efforts, Citizens has achieved a wellness challenge that allowed our colleagues to translate steps into meals donated to those facing hunger. Through our “Step Up to Fight Hunger” challenge our colleagues logged more than 540 million steps which generated a donation equivalent to 837,000 meals. | | | | | | | 2021

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - COMPENSATION MATTERS | | | 39 | | 2023 PROXY STATEMENT |

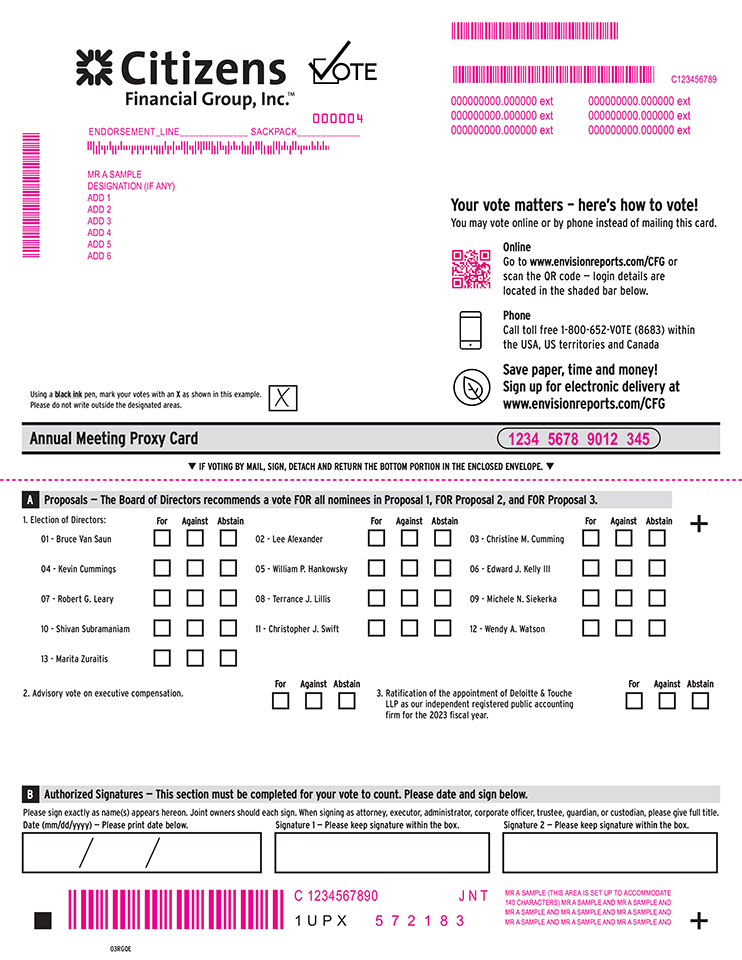

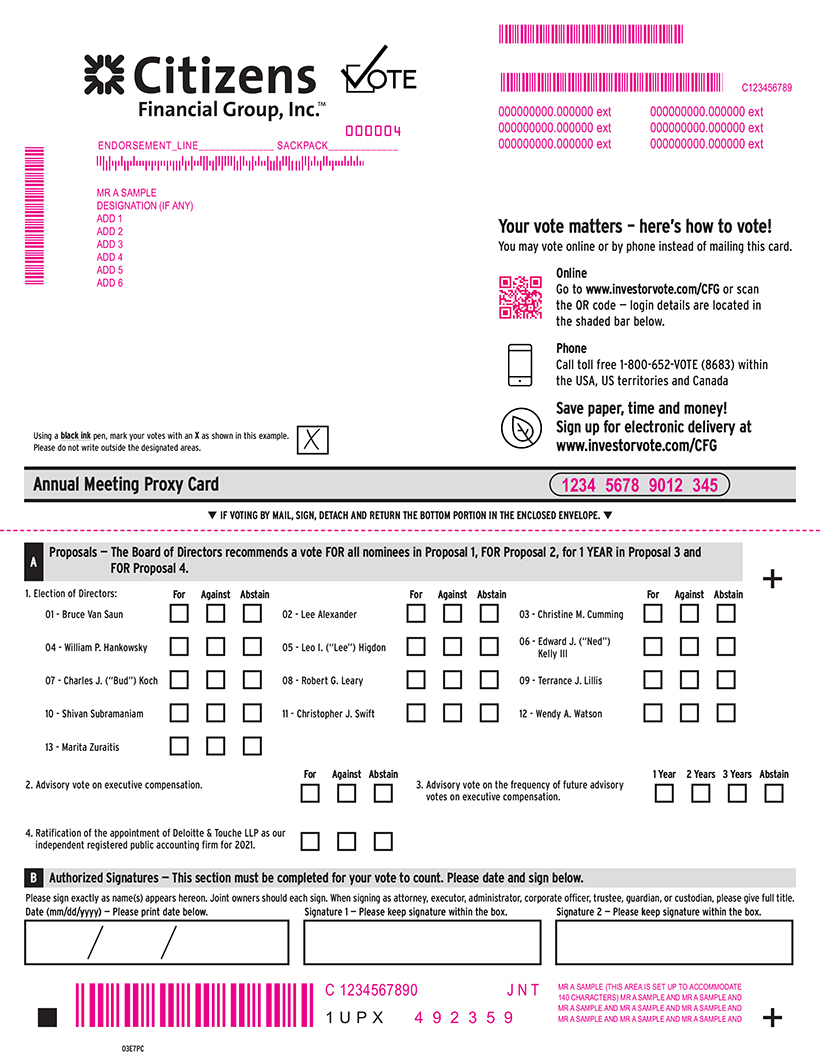

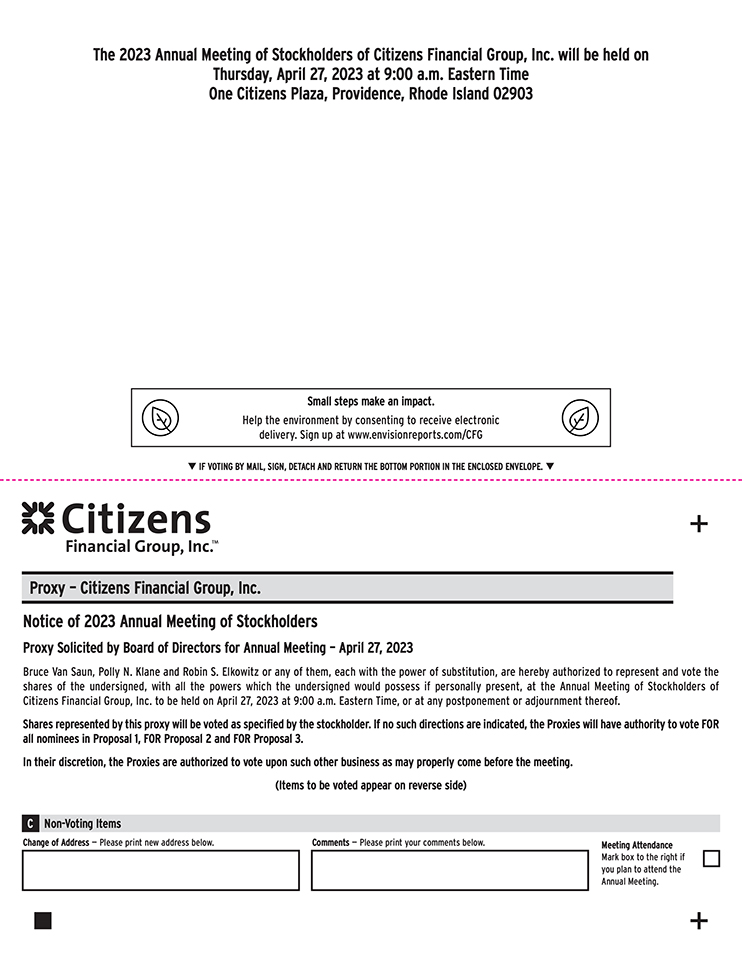

COMPENSATION MATTERS | COMPENSATION MATTERS Proposal Two — Advisory, non-binding vote for the 2022 compensation of our CEO and other named executive officers listed in the 2022 Summary Compensation Table

PROPOSAL

2

|

| Advisory, non-binding vote for the 2020 compensation of our CEO and other named executive officers listed in the Summary Compensation Table

The Board recommends FOR approval of the Company’s executive compensation The Board recommends FOR approval of the Company’s executive compensation

|

The Company provides this vote under Section 14A of the Exchange Act and in recognition of our stockholders’ vote in 20152021 recommending that we hold a non-binding, advisory vote on executive compensation each year. Following that vote, the Board affirmed thatstockholders’ recommendation and elected to hold future “say-on-pay”continued holding say-on-pay advisory votes on an annual basis. With this item, stockholders may submit an advisory vote on the compensation of our CEO and other named executive officers listed in the 20202022 Summary Compensation Table. We encourage stockholders to review the complete description of our executive compensation program provided in this proxy statement,Proxy Statement, including the Compensation Discussion and Analysis the, compensation tables, and accompanying narrative, which describe the ways we seek to align the interests of our executives with those of our stockholders. We ask our stockholders to vote on the following resolution at the Annual Meeting. RESOLVED, that the Company’s stockholders approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers in the 20202022 Summary Compensation Table, as disclosed pursuant to Item 402 of Regulation S-K (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and accompanying narrative). Although the vote on this proposal is advisory and therefore non-binding, the Compensation and HR Committee will carefully considerconsiders the results of this vote when making future decisions regarding executive compensation decisions.and related disclosure. Specific actions taken by the Company as a result of feedback received following the say-on-pay vote at our 2022 annual meeting of stockholders are described in “Compensation Discussion and Analysis—Responsiveness to Stockholders.” | | | | | COMPENSATION DISCUSSION AND ANALYSIS

CITIZENS FINANCIAL GROUP, INC. | | 40 | | 2023 PROXY STATEMENT |

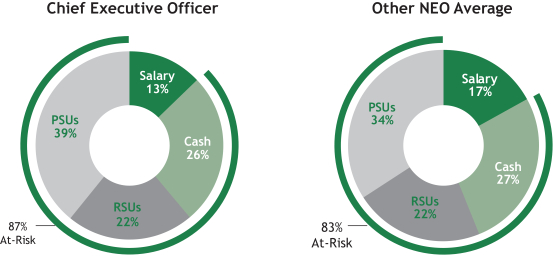

COMPENSATION MATTERS COMPENSATION DISCUSSION AND ANALYSIS This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation program and how we paidthe decision-making process and resulting decisions of the Compensation and HR Committee regarding the 2022 compensation of our named executive officers (“NEOs”) for 2020.. The Company’s NEOs for the 20202022 year are as follows:follows. | | | | | | | Name of Executive | |

| | Position | | | | | | | Bruce Van Saun | | | | Chairman and Chief Executive Officer | | | | | | | John F. Woods | | | | Vice Chairman and Chief Financial Officer | | | | | | | Donald H. McCree III | | | | Vice Chairman and Head of Commercial Banking | | | | | | | Brendan Coughlin | | | | Executive Vice President and Head of Consumer Banking | | | | | | | Malcolm Griggs | | | | Executive Vice President and Chief Risk Officer | | |

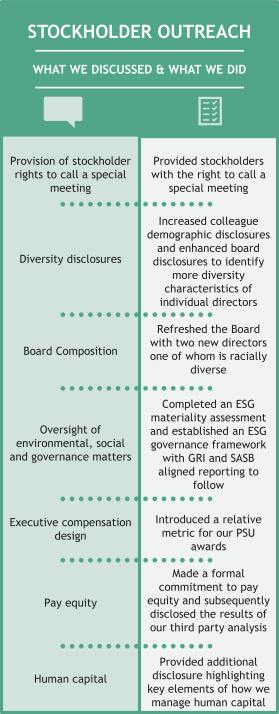

RESPONSIVENESS TO STOCKHOLDERS We value stockholder feedback related to our executive compensation program and all feedback received is shared with the Compensation and HR Committee. Stockholder feedback, which includes discussions with stockholders as well as the support level for say-on-pay, is given significant weight during the ongoing review of our program and related disclosure. Last year, our say-on-pay proposal received approximately 80 percent stockholder support. Although this represents significant support for our programs, it also represents a decrease from prior years’ support levels, which have been approximately 90 percent or higher since our initial public offering. The Compensation and HR Committee took this feedback seriously and, following the annual meeting, the Company held discussions with stockholders in order to understand how we can improve support going forward. Feedback from our stockholders was that although our pay decisions have been aligned with performance and they are generally supportive of our program, they would like to see additional disclosure linking specific performance outcomes to our pay decisions. In light of this and other feedback from stockholders, we have taken the actions detailed below. See “Corporate Governance Matters—Stockholder Engagement and Responsiveness—Stockholder Outreach” for additional information regarding our stockholder outreach program. | | | | | | | | |

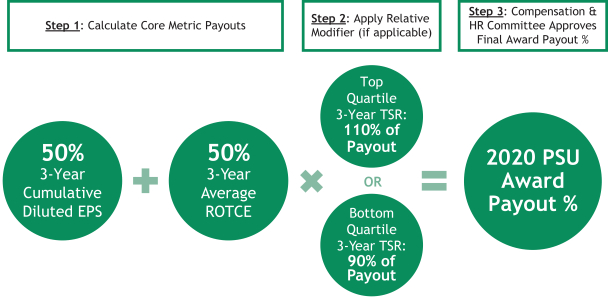

| | WHAT WE HEARD | | | |  | | WHAT WE DID | | | | Enhance disclosure of performance outcomes impacting pay decisions | |  | | This proxy includes disclosure of specific performance metrics and outcomes that were considered by the Compensation and HR Committee, and which impacted 2022 executive compensation decisions. See “—Evaluating Performance and Determining 2022 Compensation—2022 Performance Outcomes.” | | | | Susan LaMonicaContinue to evolve long-term performance award design

| |  | | In 2020, we introduced a +/- 10% Total Shareholder Return (“TSR”) modifier for our performance awards. Starting with grants in 2023, this TSR modifier increased to +/- 20%. If Company TSR performance during the applicable performance period is in the bottom quartile of peers, payout levels will be multiplied by 80%; if Company TSR performance is in the top quartile of peers, payout levels will be multiplied by 120%. | | | | Expressly identify any ESG metric outcomes considered in evaluating performance and determining pay | |  | | Executive Vice Presidentcompensation decisions are made following a review of performance metrics across various dimensions. This includes consideration of some ESG metrics, though not in a formulaic manner. In this proxy we have included colleague culture survey and Chief Human Resources Officercustomer satisfaction results, which were considered by the Compensation and HR Committee in evaluating performance and determining pay. | | | | Performance periods for performance awards should be at least three years | |  | | A very unique set of circumstances led to the grant of retention awards in May 2021 and drove the terms of those awards. We do not anticipate granting any additional long-term awards with a two-year performance period in the future. |

The CD&A is divided into five sections:

Section 1: Executive Compensation Overview

Section 2: Determining Executive Compensation

Section 3: NEO Compensation for the 2020 Performance Year

Section 4: Other Compensation and Benefits

Section 5: Governance Policies and Practices

| | | | | | | 2021

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - COMPENSATION MATTERS | | | 41 | | 2023 PROXY STATEMENT |

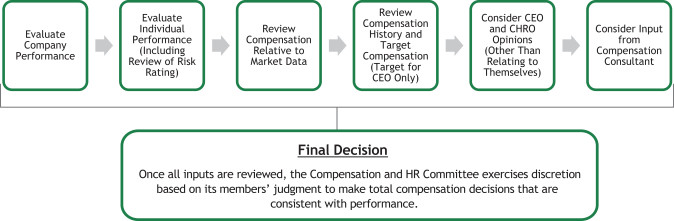

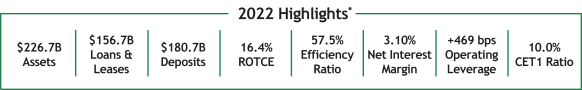

COMPENSATION MATTERS COMPANY PERFORMANCE The Company made good progress against key objectives during the course of 2022. We continued to deliver solid financial results which were ahead of internal and external expectations, executed well on strategic initiatives and successfully supported our customers, colleagues, and communities while maintaining solid credit and a strong capital position.

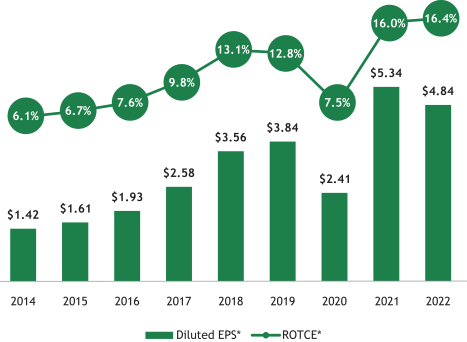

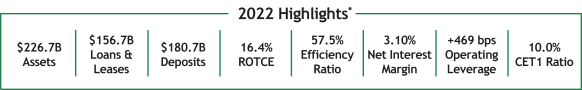

The Company has been substantially transformed since our initial public offering in 2014. The chart below reflects our long-term results on two of the core financial metrics that anchor our strategic plan. In addition, the Company’s TSR has outperformed that of our peer group since our initial public offering as well as during the most recent one-year and three-year periods. For detail, see “—Evaluating Performance and Determining 2022 Compensation—2022 Performance Outcomes—Financial Performance.”

| * | Results are presented on an Underlying basis, as applicable. See Appendix A for more information on Non-GAAP Financial Measures and Reconciliations. Unless otherwise noted, references to balance sheet items above are on a period-end basis and any comparisons are on a year-over-year basis versus 2021. For information on how we define Diluted EPS and ROTCE, see page 58. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 42 | | 2023 PROXY STATEMENT |

SECTION 1. EXECUTIVE

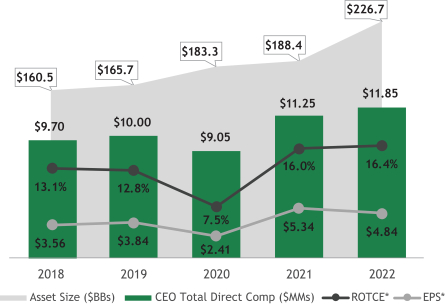

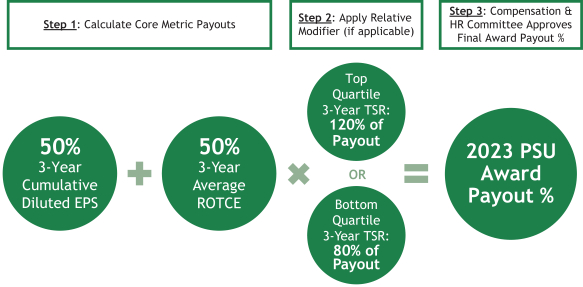

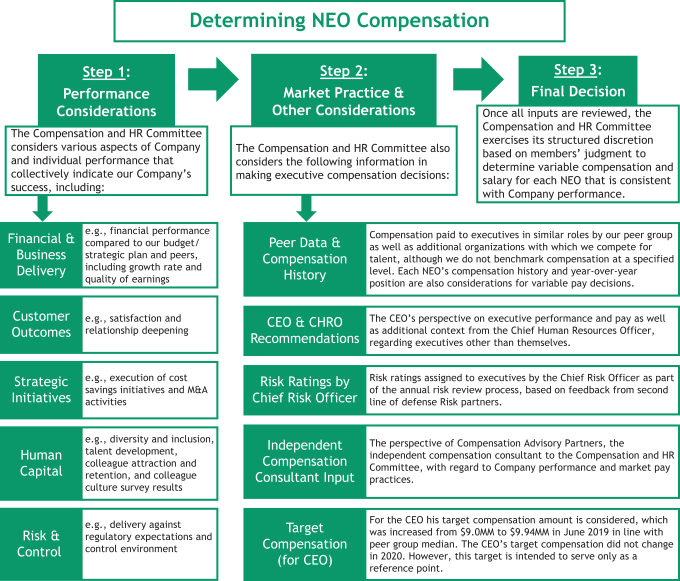

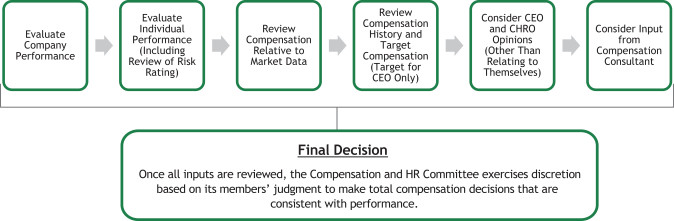

COMPENSATION OVERVIEWMATTERS EVALUATING PERFORMANCE AND DETERMINING 2022 COMPENSATION Importance of Structured Discretion Executive compensation is determined by the Compensation and HR Committee in its discretion following a comprehensive evaluation of Company and individual performance from a variety of perspectives – financial, customer, strategic, human capital, and risk. Maintaining a discretionary program instead of applying a formula allows various dimensions of performance to be considered both from qualitative and quantitative perspectives. This allows the Compensation and HR Committee to make pay decisions that reflect the overall performance level achieved and consider external factors such as macro-economic conditions (including the interest rate environment, the impact of loan reserves on earnings, and the talent environment). In addition, a discretionary program mitigates the risk of management over-focusing on certain elements of performance. Executive Compensation Philosophy The fundamental principles that guide the Compensation and HR Committee in its design of our executive compensation program and implementation ofin determining executive compensation programs for our NEOs include: | | | | |  | |

| | Pay-for-Performance.Encourage the creation of long-term value and align the rewards received by executives with returns to stockholders and long-term business objectives as well as short-term progress toward those objectives. | | |

| | Attract & Retain Talent. Attract, retain, motivate, and reward high-caliber executives to deliver long-term business performance. | | |  | | Provide alignment between annual and long-term compensation for executives and the Company’s strategic plan.

| | |

| | Support Stakeholders. Sustain a culture where colleagues recognize the importance of serving customers, fellow colleagues, and their communities well, and are rewarded for superior performance. | | |  | | Encourage the creation of value over the long-term and align the rewards received by executives with returns to stockholders.

| | |

| | Design compensation in a manner that promotesDiscourage Excess Risk Taking. Promote a culture of risk management and accountability.accountability through compensation design and related governance processes, as well as the consideration of risk performance in evaluating performance and determining pay. |

Alignment of Pay and Performance & Material Changes during 2020Process Overview

Our executive compensation program is designed to ensure that executive pay is aligned with Company performance and delivery to stockholders. Over the past six years, we have consistently demonstrated the ability to set a course, develop a plan, and execute well. This execution, led by our CEO, Bruce Van Saun, has resulted in consistently improving financial results and strong returns for our stockholders with Total Shareholder Return of 85% since our September 24, 2014 initial public offering through December 31, 2020, as compared to weighted peer average Total Shareholder Return of 62%.* We feel that the compensation for Mr. Van Saun and his team has been commensurate with this performance.

2020 has been a challenging year for the Company as it has been for most companies due to the economic impact of the COVID-19 pandemic, which was exacerbated by the implementation of the CECL accounting standards amidst the pandemic. Our management team has responded nimbly to the challenges presented, pivoting our strategy to best serve customers during this time and to ensure the safety and continued support of our colleagues and communities. Despite the challenges, our financial performance has continued to be solid, with strong performance relative to our peers on key metrics. Please see the earlier section titled “Proxy Statement Summary—Our Financial Performance.”Despite our strong 2020 relative performance, 2020 performance year variable compensation for all NEOs (including Mr. Van Saun) is down -11.1% as compared to 2019, in recognition of COVID-19 and decreased earnings. In addition, Mr. Van Saun’s 2020 performance year total compensation is down -9.5% as compared to 2019 and is also -9.0%The below his target total compensation of $9.94 million. In comparison, variable compensation for all colleagues participating in our discretionary bonus program is down -6.3% on average. 2020 performance year compensation is illustrated in “—Section 3. NEO Compensation for the 2020 Performance Year.”

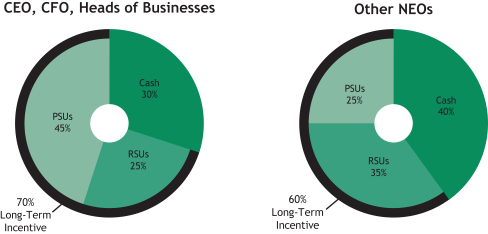

Within weeks following the March 2020 grant of our 2020 performance stock units (“PSUs”), the Average Return on Average Tangible Common Equity (“ROTCE”) and Cumulative Diluted Earnings Per Share (“Diluted EPS”) targets established for these awards no longer represented the expected performance of our Company over the next three years and were also not in line with market expectations. As a result and because the largest component of our executives’ compensation is awarded in the form of PSUs, our 2020 compensation program no longer provided the appropriate incentive and target compensation levels for our senior management team.

Following extensive discussions bygraphic illustrates the Compensation and HR Committee over the course of an eight-month period, on December 16, 2020, the CompensationCommittee’s process for evaluating executive performance and HR Committee modified the targets for the 2020 PSU awards consistent with analyst expectations as of December 15, 2020 and imposed a maximum payout of 100% of target (reduced from 150%).determining appropriate compensation.

* Peer average is market cap weighted and includes CMA, FITB, HBAN, KEY, MTB, PNC, RF, TFC and USB.

| | | | | | | 2021

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - COMPENSATION MATTERS | | | 43 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS The revised targets are intended to provide a meaningful incentive for

2022 Performance Outcomes Company Performance At meetings held in December 2022 and January 2023, the Company’s leadership team that aligns rewards with stockholder interests. The Compensation and HR Committee feels confident that the 2020 PSU modifications will help to effectively incent senior management and reward their efforts to enable the Company to emerge from this crisis and continue to deliver long-term value to stockholders. It should also be noted that in assessing final payouts under the 2018 PSUs no adjustments were made despite the impact of the pandemic on 2020 performance. For additional detail, see “—Variable Compensation Mix—2020 PSU Modification.” Additional Changes in Light of Stockholder Feedback and Continuous Review of our Program

The Compensation and HR Committee considers the results ofreviewed the Company’s advisory say-on-pay vote2022 performance, including financial as onewell as other aspects of various inputs in determining our stockholder outreach strategy forperformance. The below summarizes the upcoming year. Following the results of our advisory say-on-pay vote dropping slightly below 90% in April 2020, we expanded our stockholder outreach efforts to encompass our top 50 stockholders, who hold over 75 percent of our outstanding stock, including select stockholders that voted against say-on-pay. During the course of 2020 we held meetings with multiple stockholders, representing over 25 percent of our outstanding stock. Askey items discussed in further detail in “Corporate Governance Matters—Stockholder Engagement—Stockholder Outreach” these conversations touched on various topics, including executive compensation.

In addition, throughout each year the Compensation and HR Committee’s independent consultant provides updates regarding executive compensation trends, best practices, and regulatory developments in order to assistconsidered by the Compensation and HR Committee in evaluating Company performance and determining whether any changes to our executive compensation program should be considered.pay.

As a result of stockholder feedback and ongoing reviews of market and peer practice, we have made several changes to our compensation practices and related disclosure overFinancial Performance

Outcomes on the past few years, including the following actions: | • | | Introduction of a relative metric for PSU Awards. Starting with 2020 grants, we have incorporated relative Total Shareholder Return (“TSR”) as a metric in our PSU awards. Cumulative Diluted Earnings Per Share and Average Return on Average Tangible Common Equity remain our core metrics, with the payout percentage multipliedbelow core financial metrics were specifically considered by 110% if our TSR during the performance period is in the top quartile of our peer group or by 90% if our TSR is in the bottom quartile of our peer group. See “—Variable Compensation Mix—Performance Stock Units Design & Target Setting.”

|

Modified executive pay mix. Our review of market practice over the course of the past few years has revealed that our executive team has a higher portion of their variable compensation awarded in the form of performance awards than peers. As a result, for 2020 the Compensation and HR Committee, determined thatwhich were broadly ahead of external and internal expectations. Particular consideration was given to ROTCE, Diluted EPS, and Efficiency Ratio, which are metrics the portionCompensation and HR Committee has been monitoring closely since our initial public offering. Diluted EPS was comfortably ahead of variable compensation for NEOs2022 budget, though it was down compared to prior year results because 2021 benefited from a significant release of loan loss reserves.

| | | | | | | | | | | Metric* | | FY 2022 | | FY 2021 | | FY 2022 vs. FY 2021 | | FY 2022 vs. Budget | ROTCE | | 16.41% | | 15.98% | | +43 bps | | +285 bps | | ● | Diluted EPS | | $4.84 | | $5.34 | | -9.4% | | +5.3% | | ● | Efficiency Ratio | | 57.51% | | 59.82% | | -231 bps | | -197 bps | | ● | Pre-Provision Net Revenue ($MMs) | | $3,422 | | $2,671 | | +28% | | +9% | | ● |

The Company also achieved solid TSR levels relative to regional bank peers as well as the KBW Nasdaq Bank Index and other senior management members awardedS&P 500, over various time horizons. | | | | | | | | | | | | | | | | Total Shareholder Return | | | | | 1-Year | | | 3-Year | | | Since CFG IPO | | | | | | | | | | | | | | | | | | | | Citizens | | | -13.4% | | | | 10.7% | | | | 119.5% | | | | | | | Peer Group** | | | -16.4% | | | | -0.3% | | | | 79.0% | | | | | | | KBW Nasdaq Bank Index | | | -21.4% | | | | -2.5% | | | | 71.7% | | | | | | | S&P 500 | | | -18.1% | | | | 24.7% | | | | 124.5% | |

In addition to performance on the above financial metrics, the Compensation and HR Committee considered these additional performance results in PSUs should be reduced by 5%, with that 5% shifted into additional time-based restricted stock units. Even with this change, our Chief Executive Officer, Chief Financial Officer, and Headstheir assessment of Consumer and Commercial Banking continue to have nearly two-thirds (64%) of their long-term awards granted in the form of PSUs.performance: Increase in stock ownership requirements. We increased our CEO’s stock ownership requirement to 6x base salary (from 5x) and directors’ stock ownership requirement to 5x annual cash retainer (from 4x) in 2019.

| • | | | |  | | DisclosureDelivered on our Tapping our Potential (TOP) 7 Program efficiency commitment, which achieved pre-tax run-rate benefit of pay equity analysis results. For the last several years we have engaged an independent third-partyapproximately $115 million as of year-end 2022.

| | |  | | On track to regularly review colleague pay to ensure that equal pay is received for equal work throughoutachieve $130 million targeted pre-tax run-rate net expense synergies in connection with our organization, accounting for factors that appropriately explain differences in pay such as performance, time in role, and experience. In prior years we have published our commitment to pay equity in our Corporate Responsibility Report. This year we have also included pay equity disclosure in the proxy and have expanded it to include the results of our most recent analysis. See “Corporate Responsibility—Human Capital Management—Commitment to Pay Equity.”Investors Bancorp, Inc. acquisition by mid-2023; approximately 70% achieved through year-end 2022. |

| * | Results are presented on an Underlying basis, as applicable. See Appendix A for more information on Non-GAAP Financial Measures and Reconciliations. Unless otherwise noted, references to balance sheet items above are on a period-end basis and any comparisons are on a year-over-year basis versus 2021. |

| ** | Market capitalization weighted average TSR as of year-end 2022. |

Expanded disclosure of colleague demographics. We recently increased our level of disclosure with regard to colleague demographics on our company website.

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 44 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS | | | | |  | | Maintained strong asset quality at levels favorable to pre-pandemic levels. Annualized net charge-offs were 22 basis points. Allowance for credit losses is appropriate for our balance sheet risk profile, at 1.43% of total loans as of year-end 2022. | | |  | | Solid capital and liquidity positions, with a common equity Tier 1 capital ratio of 10.0% as of year-end 2022, at the upper end of our 9.5-10% target range. | | |  | | Continued strong external recognition of our progress. Recognized as Bank of the Year for the U.S. by The Banker, an outlet of The Financial Times. | | |  | | Significant progress on strategic initiatives as described in the next section. |

Strategic Priorities | | | Solidify and deepen customer

relationships | | ∎ In Consumer, launched Citizens Private Client in Wealth and “Banking That Stands and Grows with You,” which offers customers specially curated features and benefits. ∎ In Commercial, continued to build Commercial solution sets and diversify fee capabilities and enhanced our coverage model in key growth verticals (including Technology, Healthcare, Fintech, and Communications). ∎ Each of the businesses achieved strong customer satisfaction scores. In Consumer, we hit an all-time high in Net Promoter Score (“NPS”) (52), driven by continued material increases in customers under the age of 40. In Commercial, NPS (66), overall client satisfaction (83% very satisfied), and client satisfaction with relationship managers (92% very satisfied) scores reached all-time highs. | | Expansion into new markets | | ∎ Successful conversion of HSBC East Coast Branches and Investors Bancorp Inc. following the acquisitions and launch of a distinctive marketing strategy to increase presence and brand awareness in the NYC metro market, including a series of impactful community partnerships. ∎ Launched Consumer national online storefront with Mortgage and Student Loan Refinancing on Citizens AccessTM and increased Wealth presence in Florida. ∎ Expansion of our Commercial Banking presence in high-growth markets such as the Southeast, Texas, and California. | | Execute digital and technology initiatives | | ∎ Enhancements to our mobile app resulted in a 19% increase in mobile active users, with Citizens’ mobile app now in the top 10 in JD Power. ∎ Launch of Citizens Access mobile app and migration to cloud-based platform. ∎ Launch of Commercial Banking’s Digital Butler service, a highly secure self-serve and real-time chat channel which clients can access from their desktops and mobile capabilities in development. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 45 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS Colleagues and Community The Compensation and HR Committee also considered the Company’s continued focus on delivering well for colleagues and the communities we serve. Our ultimate goal is to create an environment where colleagues can thrive and maximize their potential and the Company continued to make colleagues a priority during 2022. Colleagues recognize our commitment to them, which is evident from the results of our OHI colleague culture survey. In 2022, survey results placed the Company in the top quartile of McKinsey’s global benchmarks. We offer colleagues comprehensive learning and development resources designed not only to prepare them better for their current roles, but also to equip them for future roles. Those resources include leadership training as well as programs that incorporate skills-based learning experiences, such as our academies. The Company remains focused on fostering a culture where all stakeholders feel respected, valued, and heard, and on increasing the representation of women and people of color through recruiting initiatives and building a strong internal pipeline. The Company met its internal 2021-2022 goal for people of color in senior leadership roles. In addition, 84% of colleagues participating in the OHI survey indicated they feel empowered to bring their authentic selves to work, which the Compensation and HR Committee believes is a testament to the Company’s continuing focus on DE&I. The Company is also committed to the well-being of colleagues and their families and continues to further complement our programs. Enhancements were made to parental leave during 2022 and the Company did not increase medical costs for 2023 in recognition of the inflationary environment. For more information on DE&I as well as our human capital strategy, see “Environmental, Social, and Governance Matters—Building The Workforce of the Future.” In addition to focusing internally on building capabilities, we continued to support the communities where we live and work. The Company’s 2022 community efforts were focused on fortifying the overall well-being of our communities, and included financial empowerment and workforce development initiatives that are described in “Environmental, Social, and Governance Matters—Fostering Strong Communities.” In addition, our colleagues volunteered more than 212,000 hours with more than 2,500 organizations and we donated 300,000 meals to Feeding America through our Step up to Fight Hunger challenge. Other Considerations The Compensation and HR Committee also acknowledged some areas with below-desired results that had an impact on NEO compensation decisions. The Compensation and HR Committee noted that fee income levels in Capital Markets and M&A were below expectations this year, but in line with the market overall. The Company built its allowance for Loan Loss Reserve in recognition of a weakening economy, which impacted earnings. In addition, although the Company did meet its internal two-year goal (2021-2022) for people of color in senior leadership roles, outcomes for African Americans and Hispanics were below desired levels due to the hyper-competitive market for diverse talent. In addition, the outcome for women in senior leadership roles was slightly below the Company’s internal two-year goal. | | | | | | CITIZENS FINANCIAL GROUP, INC. | | 46 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS Compensation and HR Committee Decision Making In arriving at NEO compensation decisions, the Compensation and HR Committee placed significant weight on Company performance, in particular 2022 results for ROTCE, Diluted EPS and Efficiency Ratio, which are key tenets of our long-term strategic plan. In addition, TSR outcomes over various periods were considered. Outcomes for these metrics and additional performance outcomes considered by the Compensation and HR Committee are described above in “—Evaluating Performance and Determining 2022 Compensation—2022 Performance Outcomes—Financial Performance.” With Company performance in mind, the Compensation and HR Committee evaluated each NEO’s individual performance. The CEO and CHRO each offered their opinion regarding the performance of executives other than themselves. The evaluation of individual performance included performance of the division managed by each NEO and its contribution to the Company’s overall success, including performance during the most recently ended year and in driving momentum toward longer-term goals. In addition, The effectiveness of each NEO’s leadership was also considered. For 2022, the exceptional leadership required to execute and integrate several acquisitions was given significant weight for each of the NEOs. The Compensation and HR Committee also considered that the Company is now the fourth largest bank among its regional peer group based on asset size, as a result of our 71% increase in Company asset size since 2014. Although the Company does not formally benchmark against a specified percentile of peer compensation, the Compensation and HR Committee believes NEO compensation levels should be appropriately positioned relative to peers based on the increased size and complexity of the bank and commensurate with the strength and experience of our senior leadership team and at an appropriate level to retain and motivate them. The Compensation and HR Committee also considered input from its independent compensation consultant, Compensation Advisory Partners, on executive pay levels in the market. | | | | | | CITIZENS FINANCIAL GROUP, INC. | | 47 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS 2022 NEO COMPENSATION The below table reflects how the Compensation and HR Committee views the direct compensation earned by each of our NEOs for performance during 2022. The amounts reported in this table differ from those reported in the 2022 Summary Compensation Table. The primary difference between the compensation amounts below and 2022 Summary Compensation Table amounts is that the below includes equity awards granted in March 2023 (for 2022 performance), whereas the 2022 Summary Compensation Table includes equity awards granted in March 2022 (for 2021 performance). | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Variable Compensation | | | Total Compensation | | | | | | | | | | | Name | | Base Salary | | | Cash(1) | | | Restricted Stock Units | | | Performance Stock Units | | | Total Variable

Compensation | | | % Chg vs.

2021(2) | | | Total Direct

Compensation | | | % Chg vs.

2021(2) | | | | | | | | | | | Bruce Van Saun | | $ | 1,487,000 | | | $ | 3,108,900 | | | $ | 2,590,750 | | | $ | 4,663,350 | | | $ | 10,363,000 | | | | +6.1 | % | | $ | 11,850,000 | | | | +5.3 | % | | | | | | | | | | John F. Woods | | $ | 700,000 | | | $ | 1,215,000 | | | $ | 1,012,500 | | | $ | 1,822,500 | | | $ | 4,050,000 | | | | +17.4 | % | | $ | 4,750,000 | | | | +14.5 | % | | | | | | | | | | Donald H. McCree III | | $ | 700,000 | | | $ | 1,215,000 | | | $ | 1,012,500 | | | $ | 1,822,500 | | | $ | 4,050,000 | | | | +14.1 | % | | $ | 4,750,000 | | | | +11.8 | % | | | | | | | | | | Brendan Coughlin | | $ | 625,000 | | | $ | 847,500 | | | $ | 706,250 | | | $ | 1,271,250 | | | $ | 2,825,000 | | | | +32.9 | % | | $ | 3,450,000 | | | | +25.5 | % | | | | | | | | | | Malcolm Griggs | | $ | 550,000 | | | $ | 800,000 | | | $ | 600,000 | | | $ | 600,000 | | | $ | 2,000,000 | | | | +7.2 | % | | $ | 2,550,000 | | | | +6.3 | % |

| (1) | The cash portion of 2022 variable compensation awards is reflected in the “Bonus” column of the 2022 Summary Compensation Table. |

| (2) | The values for PSU retention awards are excluded from 2021 performance year compensation and year-over-year comparisons. |

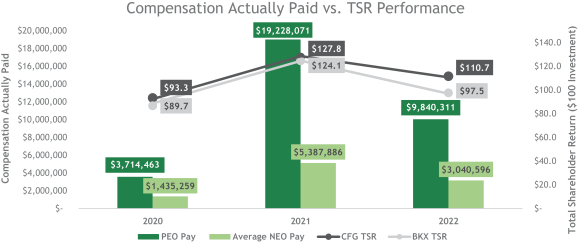

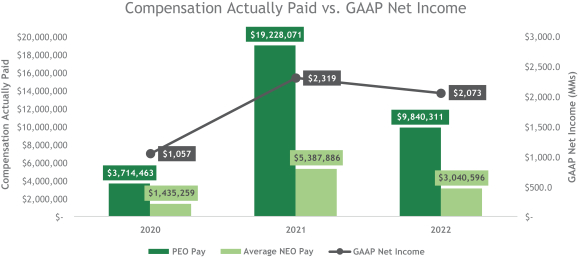

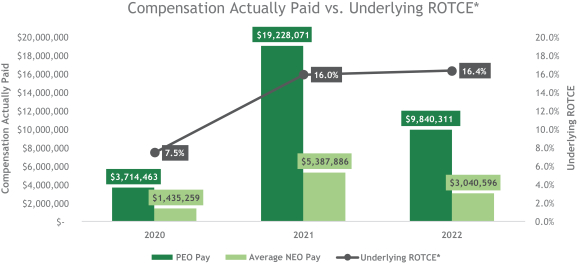

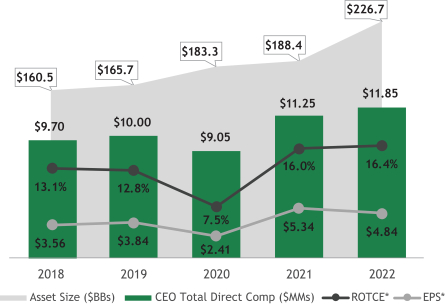

Under Mr. Van Saun’s leadership, the Company has grown in size and scope and has made strong progress relative to the strategic plan outlined by the Company at our initial public offering and subsequent updates. CEO pay decisions by the Compensation and HR Committee during the past several years demonstrate correlation between pay and two of our key financial metrics, ROTCE and Diluted EPS.

* Results are presented on an Underlying basis, as applicable. See Appendix A for more information on Non-GAAP Financial Measures and Reconciliations. Unless otherwise noted, references to balance sheet items above are on a period-end basis and any comparisons are on a year-over-year basis versus 2021. For information on how we define Diluted EPS and ROTCE, see page 58. | | | | | | CITIZENS FINANCIAL GROUP, INC. | | 48 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS Below includes additional information regarding NEO accomplishments considered by the Compensation and HR Committee as well as further context for executive pay decisions. | | | | | | |

| |

CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT - COMPENSATION MATTERS

|

|

| | Bruce Van Saun Chairman and Chief Executive Officer | | | In determining Mr. Van Saun’s compensation, the Compensation and HR Committee also considered an analysis by Compensation Advisory Partners of peer CEO pay with historic information as well as future-looking projections. In addition, the fact that Mr. Van Saun is now one of the longer tenured CEOs among the peer group was a consideration in determining his pay. | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Base Salary | | Variable Compensation | | | | Total Compensation | | | Cash

Bonus | | RSUs | | PSUs | | Total | | YoY % Change | | | | Total | | YoY % Change | | | | | | | | | | | 2022 | | | $ | 1,487,000 | | | | $ | 3,108,900 | | | | $ | 2,590,750 | | | | $ | 4,663,350 | | | | $ | 10,363,000 | | | | | +6.1 | % | | | | | | | | $ | 11,850,000 | | | | | +5.3 | % | | | | | | | | | | | 2021 | | | $ | 1,487,000 | | | | $ | 2,928,900 | | | | $ | 2,440,750 | | | | $ | 4,393,350 | | | | $ | 9,763,000 | | | | | +29.1 | % | | | | | | | | $ | 11,250,000 | | | | | +24.3 | % | | | | | | | | | | | 2020 | | | $ | 1,487,000 | | | | $ | 2,268,900 | | | | $ | 1,890,750 | | | | $ | 3,403,350 | | | | $ | 7,563,000 | | | | | -11.2 | % | | | | | | | | $ | 9,050,000 | | | | | -9.5 | % |

| | ∎ Led the Company well, as it achieved strong financial performance and completed several acquisitions (including JMP, HSBC, Investors, DH Capital, Paladin, and College Raptor), filling important gaps in our footprint and boosting capabilities in our core businesses. ∎ Remained focused on initiatives designed to enhance customer experience. In Consumer, this included digitization efforts that have yielded positive mobile app results and in Commercial the build-out of capabilities necessary to position us as a full-service bank. Customer satisfaction scores have hit all-time highs in both Consumer and Commercial. ∎ Continued attracting and retaining top talent across the organization, including the onboarding of a new General Counsel & Chief Legal Officer. Accelerated development and succession readiness for key leaders through personalized leadership programming. ∎ Achieved top quartile positioning on our Organizational Health Index (“OHI”) survey relative to McKinsey’s global benchmarks with a score of 77, which is a nearly 20 point increase since our inaugural survey in 2014. In addition, OHI responses from colleagues across all ethnicities and genders were favorable, indicating that all colleagues experience Citizens’ culture similarly. ∎ Executed key initiatives to accelerate the Company’s climate agenda, including signing of a Virtual Power Purchase Agreement with Ørsted, joining the Partnership for Carbon Accounting Financials (PCAF), publishing the Company’s first Task Force on Climate-related Financial Disclosures (TCFD) report, and executing a climate project to develop emissions baselines, risk processes, and identify high-potential business opportunities. ∎ Completed the third year of our next generation technology journey, which included continuing to improve how we deliver for customers by strengthening development capabilities and building the foundation to scale data and analytics capabilities. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 49 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS | | | | |

| | | | John F. Woods Vice Chairman and Chief Financial Officer | | | | In determining Mr. Woods’ compensation, the Compensation and HR Committee considered the heightened importance of retaining Mr. Woods in light of the significant recent growth of the Company and the integral role that he will continue to play in our strategic growth agenda. | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Base

Salary | | Variable Compensation | | | | Total Compensation | | | Cash

Bonus | | RSUs | | PSUs | | Total | | YoY %

Change | | | | Total | | YoY %

Change | | | | | | | | | | | 2022 | | | $ | 700,000 | | | | $ | 1,215,000 | | | | $ | 1,012,500 | | | | $ | 1,822,500 | | | | $ | 4,050,000 | | | | | +17.4 | % | | | | | | | | $ | 4,750,000 | | | | | +14.5 | % | | | | | | | | | | | 2021 | | | $ | 700,000 | | | | $ | 1,105,000 | | | | $ | 837,500 | | | | $ | 1,507,500 | | | | $ | 3,450,000 | | | | | +21.5 | % | | | | | | | | $ | 4,150,000 | | | | | +17.2 | % | | | | | | | | | | | 2020 | | | $ | 700,000 | | | | $ | 852,000 | | | | $ | 710,000 | | | | $ | 1,278,000 | | | | $ | 2,840,000 | | | | | -9.1 | % | | | | | | | | $ | 3,540,000 | | | | | -7.5 | % |

Highlights of our Pay Practices

| | ∎ Supported strong financial performance, meeting virtually all key financial goals for 2022. Continued to demonstrate the ability to drive operating leverage and self-fund investments in our business, with the TOP 7 Program achieving pre-tax run-rate benefit of approximately $115 million as of year-end. ∎ Led the successful delivery and integration of several acquisitions during 2022, and partnered with business leaders to sharpen the Company’s strategic focus by selecting a set of medium-term initiatives that will be pursued to create a distinctive and differentiated banking experience for customers. ∎ Continued work on balance sheet optimization that helped facilitate a shift in loan growth strategy, managed the Company’s rate and liquidity position in a volatile macro-environment, and oversaw the capital management program including a successful regulatory stress test submission. ∎ Served as co-chair of the ESG Executive Committee, which explores commercially viable ways to support client transitions to greener outcomes, and led the execution of a virtual power purchase agreement advancing the Company’s own carbon neutrality goals. Recently appointed to serve as Executive Sponsor of Citizens Awake, our disability awareness business resource group. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 50 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS | | | | |

| | | | Donald H. McCree III Vice Chairman and Head of Commercial Banking | | | | In determining Mr. McCree’s compensation, the Compensation and HR Committee placed significant importance on his success growing the capabilities of the Commercial Bank over the last several years, which positions the Company well to achieve our long-term strategic goals for the Commercial business and demonstrates the importance of retaining Mr. McCree in order for those goals to be realized. | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Base

Salary | | | Variable Compensation | | | | | | Total Compensation | | | | Cash

Bonus | | | RSUs | | | PSUs | | | Total | | | YoY %

Change | | | | | | Total | | | YoY %

Change | | | | | | | | | | | 2022 | | $ | 700,000 | | | $ | 1,215,000 | | | $ | 1,012,500 | | | $ | 1,822,500 | | | $ | 4,050,000 | | | | +14.1 | % | | | | | | $ | 4,750,000 | | | | +11.8 | % | | | | | | | | | | | 2021 | | $ | 700,000 | | | $ | 1,065,000 | | | $ | 887,500 | | | $ | 1,597,500 | | | $ | 3,550,000 | | | | +23.3 | % | | | | | | $ | 4,250,000 | | | | +18.7 | % | | | | | | | | | | | 2020 | | $ | 700,000 | | | $ | 864,000 | | | $ | 720,000 | | | $ | 1,296,000 | | | $ | 2,880,000 | | | | -12.7 | % | | | | | | $ | 3,580,000 | | | | -10.5 | % |

| | ∎ Executed on our strategy to position the Commercial Bank to deliver for clients during their full life-cycle through the build-out of targeted industry expertise (including Technology, Healthcare, Fintech, Communications) and geographic expansion through the acquisitions of JMP, Willamette, and DH Capital. ∎ Consolidated Capital Markets & Advisory activities under one leader to accelerate integration and unite under a single “go to market” strategy, and successfully transitioned Global Markets business to new leadership and diversified our offerings with results up significantly over last year and plans to further broaden capabilities. ∎ Expanded customer solutions, including the Carbon Offset Deposit Account and payment automation via accessOPTIMATM, and a new market-based pricing system, which culminated in Commercial receiving all-time high net promoter, relationship manager, and overall satisfaction scores. ∎ Enhanced diversity in key client-facing leadership roles such as Head of Commercial Real Estate, Head of New York City metro market, and Head of Michigan market. Continued strong diversity in our junior banker programs which are typically a strong feeder into leadership roles, and served as Executive Sponsor of Citizens PRISM, our multi-cultural business resource group. |

| | | | | | CITIZENS FINANCIAL GROUP, INC. | | 51 | | 2023 PROXY STATEMENT |

COMPENSATION MATTERS | | | | |

| | | | Brendan Coughlin Executive Vice President and Head of Consumer Banking | | | | In determining Mr. Coughlin’s compensation, the Compensation and HR Committee recognized that Mr. Coughlin was promoted to the role of Head of Consumer Banking in 2020 from another role internally, which was a significant expansion of scope and responsibilities. As a result, it was appropriate for his compensation to increase toward a market level commensurate with his current role, which is a factor contributing to his year-over-year increase. | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | | Base

Salary | | Variable Compensation | | | | Total Compensation | | | Cash

Bonus | | RSUs | | PSUs | | Total | | YoY %

Change | | | | Total | | YoY %

Change | | | | | | | | | | | 2022 | | | $ | 625,000 | | | | $ | 847,500 | | | | $ | 706,250 | | | | $ | 1,271,250 | | | | $ | 2,825,000 | | | | | +32.9 | % | | | | | | | | | $3,450,000 | | | | | +25.5 | % | | | | | | | | | | | 2021 | | | $ | 625,000 | | | | $ | 637,500 | | | | $ | 531,250 | | | | $ | 956,250 | | | | $ | 2,125,000 | | | | | +49.1 | % | | | | | | | | | $2,750,000 | | | | | +34.1 | % |